Set Yourself Up for the New Financial Year

It’s the new financial year! Now is the perfect time to take stock of what’s ahead in terms of superannuation, aged care, and other rules. It’s also a great opportunity to review your financial position, set new goals, and make a clear plan for the year ahead.

Here are a few rule changes that might create opportunities for some and, perhaps, risks for others.

Key Changes Coming from 1 July 2025

(A) Transfer Balance Cap (TBC) Increase

The general Transfer Balance Cap will rise from $1.9m to $2m due to CPI indexation. The Transfer Balance Cap is a lifetime limit on the amount an individual can move from a superannuation accumulation account to the tax-free retirement phase.

There are flow-on effects from this increase:

The Defined Benefit Income cap will rise from $118,750 p.a. to $125,000. This is the threshold above which tax concessions are reduced for individuals receiving income from capped defined benefit income streams.

The limit which prohibits an individual from claiming the tax offset for superannuation contributions they make on behalf of their spouse will increase from $1.9m to $2m.

The limit which determines if an individual is entitled to a government super co-contribution will increase to $2m.

(B) Changes to After-Tax Contribution Limits

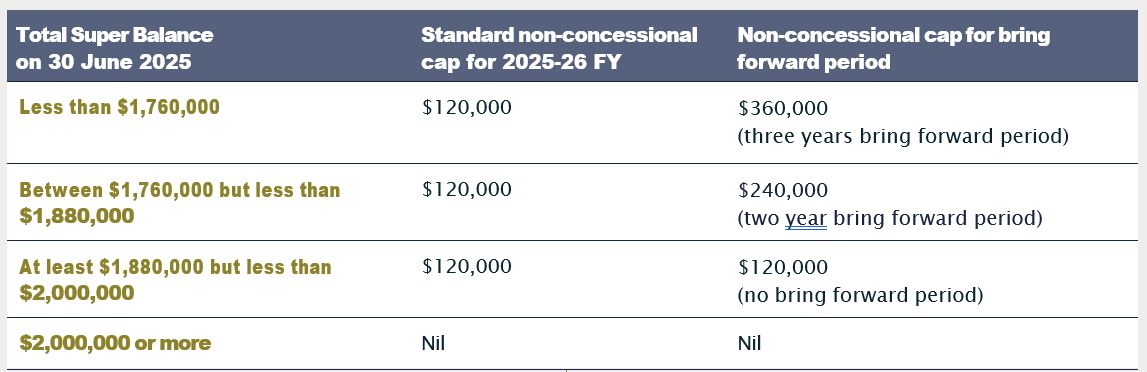

While the annual non-concessional (after-tax) and concessional (before-tax) contribution caps remain unchanged, the thresholds for accessing the bring-forward rule are increasing. This rule allows you to contribute up to three years of non- concessional contributions in one go, depending on your Total Super Balance (TSB) as at 30 June (see table below).

If you were previously unable to make after-tax contributions due to your TSB, this change may make you eligible. Speak with your Financial Adviser to check your options.

(C) New Aged Care Act 2024

(Includes Home Care)

It was announced on 4 June that the Aged Care Act 2024, that was due to take effect effect on 1 July 2025, has been deferred to commence on 1 November 2025, and replaces existing legislation to establish a new rights-based framework for aged care. There are also changes to the fees and costs of aged care for new entrants after 1 November 2025.

From 1 November 2025, the Support at Home program will replace the current Home Care Packages and Short-Term Restorative Care programs. What’s not changing is that you must still be aged 65* to be eligible to access Government subsidised home care. Services like personal care, domestic help, nursing, meals, and home modifications will still be available, however the funding model will change, and the amount of user co-contribution may also change. Note this new change does not apply to existing home care package recipients.

(D) Superannuation Guarantee (SG) Rate Increase

The Superannuation Guarantee (SG) rate which is the statutory minimum amount an employer must contribute to their staff’s superannuation, increases from 11.5% to 12% from 1 July 2025. This means more super going into your account from your employer, which can make a big difference over time.

(E) Parental Leave Payment Changes

From 1 July 2025, Parental Leave Pay will increase to 120 days, which is 24 weeks based on a five-day work week. There are also changes to how many days are reserved for your partner and how many days you can take at the same time.

A superannuation contribution will also be added to the payment.

Ways You Can Take Control of Your Finances in the New Year

Planning now for 2025–26 gives you a head start and can help you focus on clear, achievable goals. Here are some tips to get you started:

Start by reviewing your financial statements from the last year. Look for things like:

Where your money was spent

How much you paid in fees or interest

Any recurring subscriptions and “emotional spending”

This review can help you identify ways to reduce expenses and save some money next year. This also allows you to have a better understanding of your financial obligations including your regular bills, loan repayments and when they are due. Better understanding can help remove anxiety and stress and help you feel more in control.

You may even wish to challenge yourself with a “no-spend challenge” for a week or month.

Write Down Your Goals

Whether your goals are financial or not, one of the best things you can do is write them down. Writing down your goals has several practical benefits that can significantly increase your chance of achieving them. A written goal forces you to be specific about what you want. Once you have defined what success looks like, it is much easier to take action. You are more likely to remember and stay committed to the goals you’ve written down.

Create a Realistic Budget

Creating a realistic budget and sticking to it is an important part of taking control of your finances. Categorise your spending into needs (e.g. rent/ mortgage repayment, food, transport, utility bills) and wants (e.g. dining out, entertainment, subscriptions), and assign dollar limits to each category. A general rule of thumb is to use the 50/30/20 rule, which is 50% allocation to needs, 30% to wants and 20% to savings/debt reduction.

Once you know how much you could potentially save, make sure you talk to a Financial Adviser about starting a regular savings plan either into an investment portfolio or your super.

Talk to a Financial Adviser

Talking to a Financial Adviser can be one of the most impactful steps in taking control of your finances, especially when navigating complex areas like investing, tax planning, superannuation, or preparing for retirement.

A qualified Financial Adviser can help you clarify your goals, develop a personalised financial strategy, and avoid costly mistakes. They bring professional insight that goes beyond general advice, helping you make informed decisions tailored to your specific circumstances.

Your Vision Financial Solutions Pty Ltd ABN 64 650 296 478 and its Advisers are Authorised Representatives of Fortnum Private Wealth Ltd ABN 54 139 889 535 AFSL 357306. This article has been prepared without taking into account your personal objectives, financial situation or needs. Before acting on any information on this article you should consider the appropriateness of the information having regard to your objectives, financial situation and needs.